The Ethereum price has been one of the major talking points in the crypto space lately, having been under significant bearish pressure in recent weeks. However, the second-largest cryptocurrency seems to be on a recovery path following its first positive weekly performance in more than a month.

Recent on-chain data shows that significant amounts of ETH tokens have made their way to centralized exchanges in the past day. The question now is — could this hamper the recent progress shown by the Ethereum price?

Here’s How Rising Exchange Inflow Affects Ethereum Price

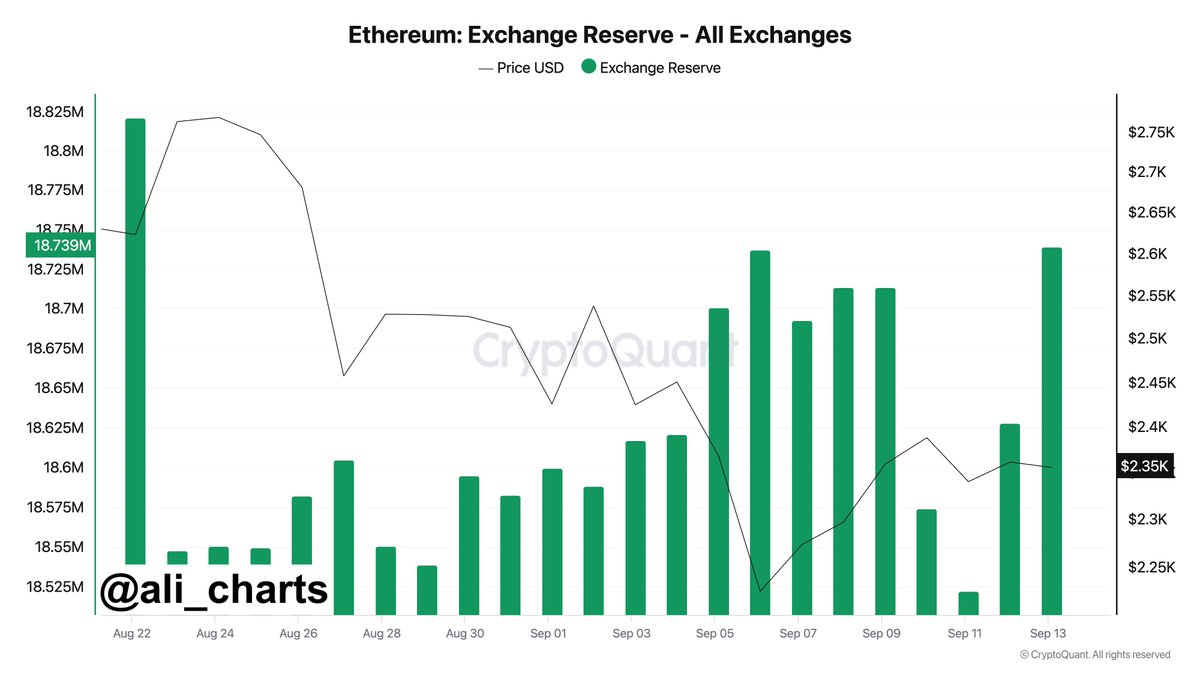

Prominent crypto pundit Ali Martinez took to the X platform to that Ethereum investors have been moving their assets to centralized exchanges in the past 24 hours. This on-chain observation is based on the CryptoQuant exchange reserve metric, which monitors the total amount of a particular cryptocurrency on all exchanges.

Typically, the value of this metric increases when investors make more deposits than withdrawals of a token (Ether, in this case) into a centralized exchange. On the flip side, when the exchange reserve metric falls, it implies that the holders are moving their assets out of crypto exchanges.

When investors move their assets from self-custodial wallets to centralized exchanges, it is often because they intend to use the platforms’ services, which include selling. As a result, an increase in the exchange reserve metric is often associated with increasing selling pressure.

According to data from CryptoQuant, more than 112,000 ETH (worth around $257.6 million) were transferred to cryptocurrency exchanges in the last 24 hours. The movement of these significant Ether amounts could trigger downward pressure on the Ethereum price.

Considering its delicate position at the moment, bearish circumstances, such as rising exchange inflows, could hinder the Ethereum price’s newly found momentum. Nonetheless, it is worth noting there has not been such an effect on ETH’s price in the past day. On the contrary, the altcoin is up by more than 3% while looking to breach the $2,500 level.

Are Investors Fleeing The Market?

The latest on-chain data that investors might be flooding out of the Bitcoin and Ethereum markets. According to Ali Martinez, over $2.6 billion has flowed out of the two largest cryptocurrencies in the last seven days.

This revelation is based on Glassnode’s aggregate market realized value net position change metric. And it somewhat supports the earlier notion that investors might be offloading their Ether tokens.

Moreover, this outflow of capital could spell more trouble for the crypto market, specifically the Bitcoin and Ethereum prices.